| P&E Plumbing and Building Maintenance Inc. |

BACK返回主页 |

A Letter to the Property Management Company

致房产管理公司的一封信

Dear Property management company,

Greetings!

It is crucial for us to establish a mutually beneficial relationship with your esteemed company. We value every opportunity to collaborate with you. As a plumbing, electrical, heating, and cooling installation and service company, we have always been committed to providing efficient and timely solutions to our clients' problems, constantly demonstrating a high level of professionalism and technical expertise. Each maintenance task is swiftly and accurately resolved. Our service attitude is also very friendly and considerate, always prioritizing customer needs, providing great peace of mind and satisfaction to tenants, landlords, and your esteemed company. Additionally, our work efficiency is very high, ensuring that all maintenance requests receive prompt responses and handling. In summary, our company has earned the trust and praise of many long-term clients with our excellent service and professional skills.As we all know, the plumbing industry is highly prone to risks, and any incident can result in quite expensive damages, especially in apartments. As a property management company, there is no need for you to risk hiring unlicensed and uninsured individuals for repairs. If the floor gets flooded, leaks down to the lower floors, and causes mold on all the walls and interlayers, with damages exceeding $100,000 CAD, and the individual responsible disappears and cancels their phone number, all the remedial work would fall on the property management company to compensate for the losses. These cases are not uncommon, and we often urge management companies not to be penny-wise and pound-foolish.

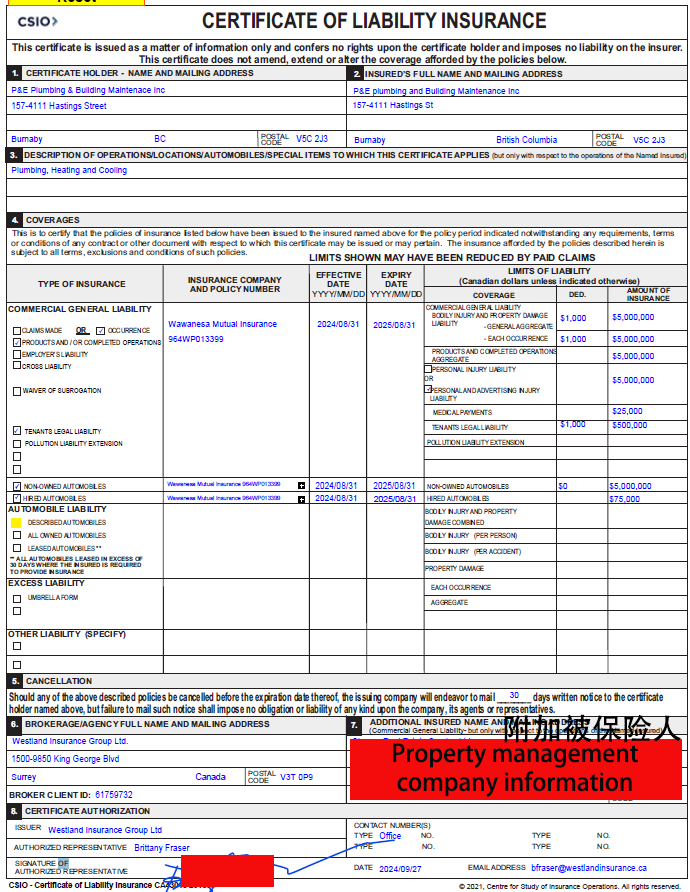

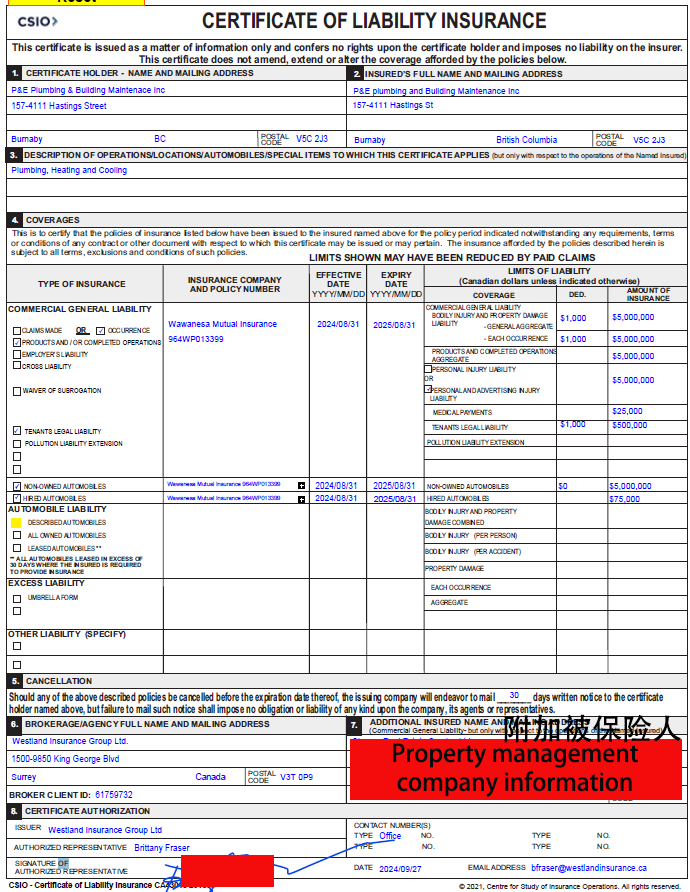

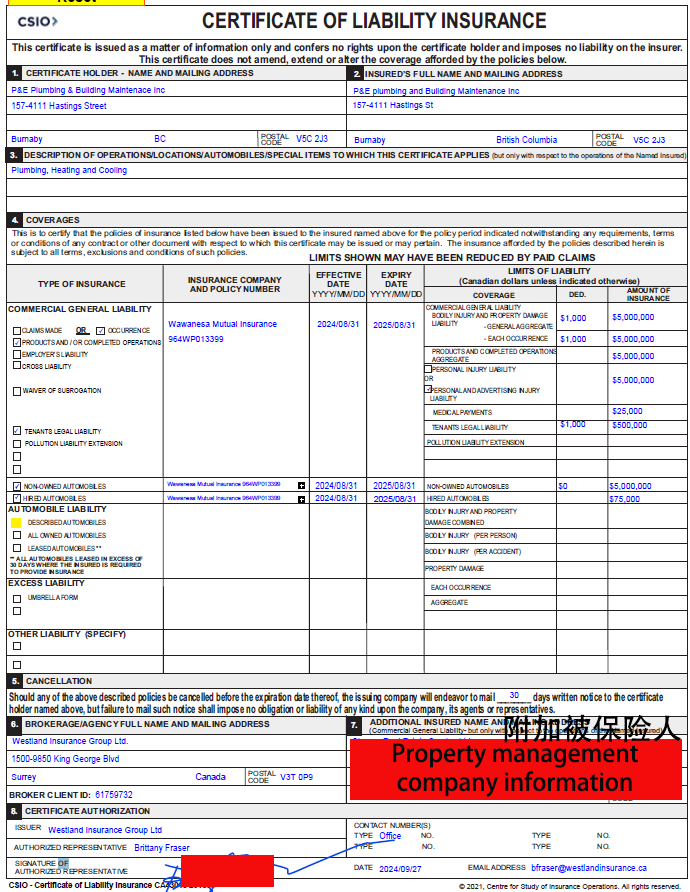

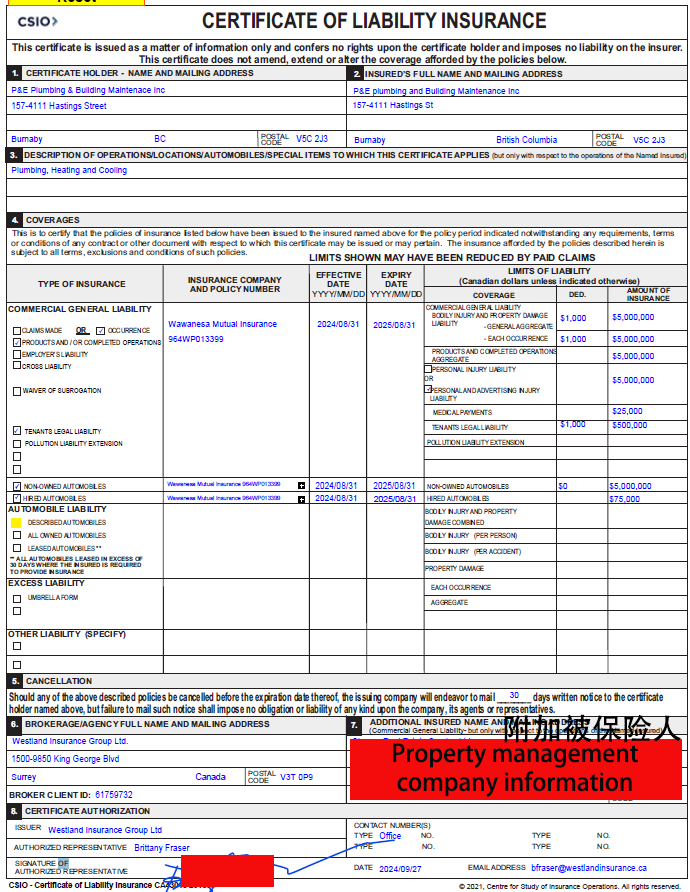

To reassure the management companies we cooperate with, we typically add your company's name to the "Additional Insured" $5 million Commercial Liability Insurance policy after we have collaborated three times. This way, in case of any losses, the property management company can use this policy to recover all damages for their clients. A sample of the policy is as follows:

By summarizing the successful cases of our cooperation with many property management companies, we have found that those property management companies that respect the labor and pricing of service companies can ensure timely and high-quality maintenance services and gain the trust and priority support of service companies. Conversely, if prices are continually lowered or payments are delayed, it may lead to reduced service quality or even a refusal to cooperate, thereby affecting tenant satisfaction and your company's reputation. Establishing a win-win relationship, your esteemed company can motivate maintenance companies to provide superior and reliable services through reasonable pricing, timely payments, and ongoing cooperation. This not only helps in maintaining the property in good condition but also enhances the tenant's living experience and overall satisfaction, eliminating landlords' concerns and preventing unnecessary complications. Ultimately, achieving a win-win situation for all parties involved. (Note: If landlords are willing to intervene in property matters, including directly contacting service companies and settling accounts, property management companies should be more willing, but it is important to include relevant exemption clauses in the property management contract.)

We understand that your esteemed company has always been dedicated to playing an important role in connecting landlords with tenants and landlords with service companies. Sometimes, you may encounter landlords who intentionally make things difficult, leading to payment delays. Each payment delay poses an operational challenge for our service company. Employee salaries, material procurement, and daily operations of the company all require stable cash flow support. During this process, we would like to particularly emphasize the impact of capital costs on pricing. According to capital cost theory, when setting pricing strategies, companies need to consider their capital costs, including the cost of debt and the expected return of shareholders. Each payment delay increases our capital costs, thus affecting our ability to set reasonable pricing.

To illustrate this point, here are some data and mathematical models we use in our pricing process:

WACC Calculation Formula: (Based on a 30-day payment waiting period) Our current Weighted Average Cost of Capital (WACC) is 9.5%. This figure is derived from our current debt costs and the expected returns of our shareholders. The formula is:

WACC=(EV)×Re+(DV)×Rd×(1−Tc)

Where, E is the total equity, V is the total value of the company, Re is the cost of equity, D is the total debt, Rd is the cost of debt (calculated based on a 30-day payment waiting period), and Tc is the tax rate. Based on a 15-day payment waiting period, our WACC is 5%. Our company does not accept payment periods exceeding 30 days. Payments made within 24 hours have a WACC of 0.

Pricing Model: (Based on a 30-day payment waiting period) Based on capital costs and expected profit rates, we have formulated the following pricing model:

Final Price=Initial Price+(Cost×WACC) / (1−WACC)

Assuming our repair pricing is $1000, the final price calculated through the model is:

1000 +(1000×0.095)/(1−0.095)=1000+104.97=1104.97

(Based on a 15-day payment waiting period, the final price would be $1052.63)

These data and models illustrate how we formulate reasonable pricing strategies based on capital costs and expected profit margins. Payment delays increase our capital costs, potentially causing us to raise service prices to offset these increased costs. For future collaborations, if your company requires a payment waiting period of 15 or 30 days, please inform us before we provide a quote. We will adjust our pricing according to company policies to account for both implicit and explicit cost increases. If not explicitly stated, we will assume payment is due on the day of service completion.

Thank you for taking the time to read this letter. We sincerely look forward to working with your esteemed company to tackle market challenges and achieve our mutual long-term goals.

Yours sincerely,

P&E Company Finance Department

Important Notice

To maintain a transparent market and uphold a fair trading system, we do not offer any form of kickbacks to property management managers. If you require any kickbacks, please make this clear before we provide a quote. Do not intentionally delay payment to indirectly or covertly demand intermediary fees.

尊敬的房产管理公司:

您好!

能与贵公司的建立互惠互利的合作关系对我们来说至关重要。我们珍惜每一次和贵公司合作的机会。我们作为一家水、电、冷、暖安装维修公司,我们一直致力于提供高效,及时解决客户难题,随时展现出高度的专业精神和技术水平,每次维修都能迅速准确地解决问题。我们的服务态度也非常友好和贴心,总是以客户的需求为优先,给予了租户和房东以及贵公司极大的安心感和满意度。不仅如此,我们的工作效率极高,确保了所有维修请求都能得到及时的响应和处理。总之,我公司用出色的服务和专业的技能赢得了广大老客户的信赖和好评。众所周知,水工这个行业是最容易出现风险,且一旦出事必将造成相当昂贵的损失,特别是公寓。作为房屋管理公司的您,完全没有必要找一些没有政府牌照和商业保险的人去冒险修理,到时候水淹了地板,漏到楼下并导致所有墙面和夹层发霉,损失十万加币以上,对方跑了并把电话注销了,所有的善后工作都是由房屋管理公司赔偿损失。这种案例并不少见,我们也时常呼吁管理公司不要贪图便宜。同时,为了让合作的管理公司放心,我们一般会在双方合作了三次之后,我们会将贵公司的名字加入到"附加被保险人"500万商业责任险保单里,这样一旦产生任何损失,房产管理公司将可以凭这个保单为客户挽回所有损失。保单样张如下:

通过总结和我们合作的大量的房产管理公司的成功案例,我们发现那些尊重维修公司的劳动和价格的房产管理公司不仅可以确保及时和高质量的维修服务,还能赢得维修公司的信任和优先支持。反之,如果一味压低价格或者拖欠款项,可能会导致维修公司减少服务质量甚至拒绝合作,进而影响租户的满意度和贵公司的声誉。建立双赢关系,贵公司可以通过合理的价格、及时的付款和持续的合作激励维修公司提供更加优质和可靠的服务,这不仅有助于维护房屋的良好状态,也能提升租客的生活体验和整体满意度,免除了房东的后顾之忧以及一些完全没有必要的节外生枝。最终实现多方共赢。(提示:如果房东自己愿意介入维修事宜,包括自己联系维修公司,和维修公司结算等等,房产管理公司其实应该更加乐意,但要注意的是,必须把相关的免责条款加入到房产管理合同中去)

我们深知,贵公司一直持续地竭尽全力地在连接房东与租客之间,房东与维修公司之间扮演着重要的角色,有时也会遇到房东故意刁难的情况,导致付款延误。但每一次的付款延迟,对于我们维修公司而言,都是一次运营上的挑战。员工的薪资、材料的采购、公司的日常运营,这些都需要稳定的现金流来支持。在这个过程中,我们希望特别强调资金成本对定价的影响。根据资本成本理论,企业在制定定价策略时,需要考虑其资本成本,包括债务成本和股东所期望的回报。每一次的付款延迟都增加了我们的资本成本,从而影响到我们制定合理定价的能力。

为了具体说明这一点,以下是我们在定价过程中使用的一些数据和数学模型:

资金成本 (WACC) 计算公式:(按30天的支付等待周期来计算)我们公司当前的加权平均资本成本(WACC)为9.5%。

这个数据是基于我们目前的债务成本和股东所期望的回报率计算得出的。公式为: WACC = (E/V) * Re + (D/V) * Rd * (1 - Tc) 其中,E为股权总额,V为企业总价值,Re为股权成本,D为债务总额,Rd为债务成本(按30天的支付等待周期来计算),Tc为税率。按15天的支付等待周期来计算的话,我们公司WACC为 5% . 我公司暂不接受30天以上的付款周期。付款在24小时以内的WACC为0.

定价模型:(按30天的支付等待周期来计算)基于资金成本和预期利润率,我们制定了以下定价模型: 最终定价 = 最初定价 + (Cost * WACC) / (1 - WACC) 假设我们的维修定价为$1000,通过模型计算得出最终定价为: 1000 + (1000 * 0.095) / (1 - 0.095) = 1000 + 104.97 = 1104.97 (15天的支付等待周期则得出最终定价为1052.63)

这些数据和模型说明了我们如何基于资金成本和预期利润率制定合理的定价策略。付款的延误增加了我们的资金成本,可能导致我们不得不提高服务价格以应对资金成本的增加。如果在未来的合作中,如果贵公司需要有15天或者30天的支付等待周期,请贵公司在我们报价之前明确提出来,我们会根据公司政策提高报价,以应对隐性和显性的成本增加。如果没有明确提出的,我们都默认为是维修结束的当天付款。

感谢您抽出宝贵的时间阅读此信。我们真诚地期待着与贵公司的合作,共同应对市场的挑战,实现双方的长远目标。

此致,

敬礼

P&E 公司财务部

特别提示

为了保持市场的公开透明,维护公平的交易体系,我们坚决不向房屋管理经理提供任何形式的回佣。如果您有回佣的需求,请在我们报价前明确说明。请勿在付款时故意拖延,以间接或变相的方式索取中介费。